A similar Schedule of Accounts Payable, made up of all the balances in the Purchase Ledger, is prepared, and it must agree with the balance of the Accounts Payable account of the General Ledger." The Balance Sheet.-In the more elementary part of the text, the student learned how to prepare a Statement of Assets and Liabilities for the purpose of disclosing the net capital of an enterprise.

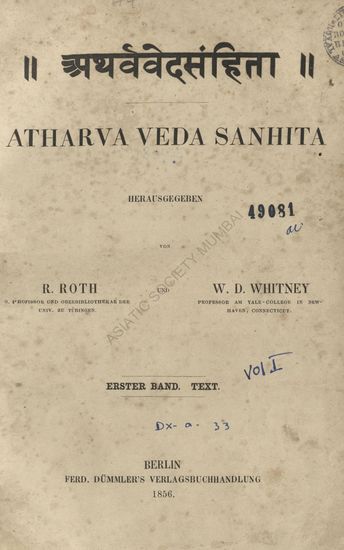

#Whitney atharva veda trial#

A Schedule of Accounts Receivable is then prepared, consisting of the balances found in the Sales Ledger, and its total must agree with the balance of the Accounts Receivable account shown in the Trial Balance. It is evident that the task of taking a Trial Balance is greatly simplified because so many fewer accounts are involved. The Trial Balance now refers to the accounts in the General Ledger. The original Ledger, now much reduced in size, is called the General Ledger. The customers' accounts are then segregated in another book called the Sales Ledger or Customers' Ledger, while the creditors' accounts are kept in the Purchase or Creditors' Ledger. These summary accounts, respectively, displace individual customers' and creditors' accounts in the Ledger. The most common examples of such accounts are Accounts Receivable account and Accounts Payable account. Controlling Accounts.-The addition of special columns in books of original entry makes possible the keeping of Controlling Accounts. (6) Columns for Discount on Purchases and Discount on Notes on the same side of the Cash Book (c) Columns for Discount on Sales and Cash Sales on the debit side of the Cash Book (d) Departmental columns in the Sales Book and in the Purchase Book. Purchasers can usually download a free scanned copy of the original book (without typos) from the publisher. This historic book may have numerous typos and missing text.

0 kommentar(er)

0 kommentar(er)